Exciting news from Federal Reserve Chair Jerome Powell! During a conference in Portugal, Powell expressed optimism about the US economy and decreased the possibility of a recession. He highlighted the economy’s resilience and continued growth, albeit at a modest pace. While acknowledging the potential for a recession, Powell emphasized that it is not the most likely scenario. The Federal Reserve recently paused its series of interest rate hikes after ten consecutive increases. Powell mentioned that the Fed’s goal is to slow down the economy and reduce consumer demand to curb inflation, which is currently double the Fed’s target of 2%. The policy approach seems to be working, as economic activity has slowed while consumer spending and hiring remain strong. The labor market experienced robust job growth in May. Despite a slight slowdown in wage increases, Powell sees it as a positive development in the fight against inflation. Overall, he believes that finding a balance without a severe downturn is the most plausible outcome.

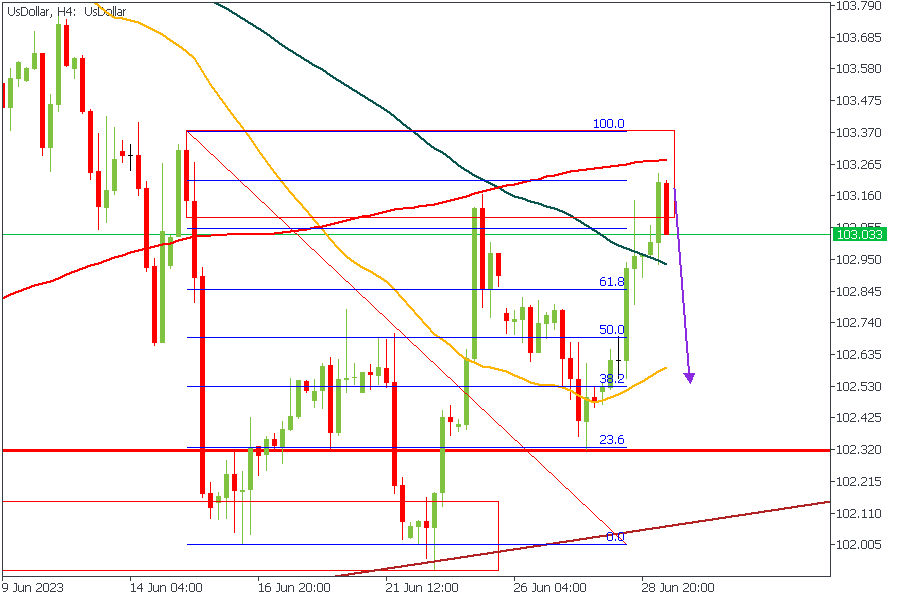

US DOLLAR – H4 Timeframe

Let’s take a look at the 4-hour timeframe of the US Dollar. The price has now reached a crucial supply zone that overlaps with the 200-period moving average, while the moving averages are arranged in descending order. This suggests a high likelihood of rejection from that zone, leading to a bearish impulse for the Dollar.

Analyst’s Expectations:

Direction: Bearish

Target: 102.221

Invalidation: 103.258

XAUUSD – D1 Timeframe

As we’ve discussed before, the price action of the US Dollar often correlates negatively with that of the XAUUSD commodity. Gold is often used as a safety net to hedge against inflationary forces and economic instability. Given the weakening USD, we can expect bullish price action from Gold. Let’s see what the lower timeframe reveals.

XAUUSD – H4 Timeframe

On the H4 timeframe, XAUUSD has reached a demand zone and is likely to experience a quick reversal from this area, in line with the correlation against the US Dollar. Additionally, there is trendline support intersecting this demand zone, further supporting the bullish sentiment. Therefore, I believe the price action will favor the bulls.

Analyst’s Expectations:

Direction: Bullish

Target: 1945.73

Invalidation: 1885.80

CONCLUSION

Trading CFDs carries risks, so proper risk management is crucial for success. To avoid costly mistakes while exploring these opportunities, be sure to conduct thorough research and manage your risk effectively.

For more trade ideas and timely market updates, check out our telegram channel.

GOLD: US Dollar Hits Supply Zone, What Next?

Gold, often seen as a safe haven during times of economic uncertainty, has been experiencing notable volatility in recent months. The focus of traders and investors has centered on the relationship between gold and the US dollar, with gold prices heavily influenced by fluctuations in the greenback. As the US dollar hits a crucial supply zone, market participants eagerly anticipate its next move and the potential impact on the precious metal.

The US dollar has traditionally held a strong inverse relationship with gold prices. When the dollar weakens, gold tends to rally, and vice versa. This dynamic has been at play recently as well, with the US dollar index (DXY) experiencing significant downward pressure since the start of the year. The Federal Reserve’s dovish stance and historic monetary easing measures undertaken to combat the economic fallout of the pandemic have contributed to the weakening of the dollar.

As the US dollar weakened, gold benefited, reaching a record high of $2,072 per ounce in August 2020. However, since then, gold prices have faced substantial downward pressure, and in March 2021, gold dipped below the psychological threshold of $1,700. The strengthening of the US dollar in the past few months has put gold in a precarious position, and market observers are now waiting to see if this trend will continue or if gold will regain its luster.

The US dollar has now entered a crucial supply zone, where it has historically found strong resistance and reversed course. This zone has proven to be an inflection point, leading to significant price movements in the past. As the dollar attempts to extend its rally, traders and investors are closely watching for signs of a potential rejection at this level.

A rejection from this supply zone could reignite bullish sentiment in the gold market. Investors who had sold their gold holdings in favor of the US dollar may seek to re-enter the gold market, driving prices higher in the process. Furthermore, a retreat from the supply zone would indicate a potential reversal in the US dollar’s upward trajectory, which could continue to support gold prices in the longer term.

However, should the US dollar break through this supply zone, it could signal further downward pressure on gold prices. A sustained rally in the dollar may lead to increased selling in gold as investors perceive the greenback as a more attractive asset. This scenario could push gold prices to test key support levels and potentially trigger a deeper correction in the market.

Several factors could influence the next move of the US dollar and gold prices. The Federal Reserve’s monetary policy decisions, economic data, and global geopolitical events will likely play a significant role. Additionally, any signs of rising inflation or a weakening global economy could impact the relationship between gold and the US dollar.

In conclusion, gold finds itself at a critical juncture as the US dollar hovers around a crucial supply zone. The outcome of this battle will greatly determine the future direction of gold prices. Market participants eagerly await clues from the US dollar’s behavior and its impact on the precious metal. As the world grapples with ongoing economic uncertainties, the movements in gold and the US dollar will undoubtedly be closely monitored by traders and investors alike, hoping to navigate these uncertain times successfully.