- Gold Price remains dicey as bears attack the key support while seeking confirmation of hawkish Fed bias.

- Fed’s preferred inflation, FOMC Minutes and NFP will be crucial to watch for clear XAU/USD directions.

- US-China headlines, central bankers’ speeches may entertain the Gold sellers.

Gold Price (XAU/USD) is facing uncertainty as bears continue to target key support levels, eagerly awaiting confirmation of a hawkish Fed bias. Traders should closely monitor the Fed’s preferred inflation indicators, FOMC Minutes, and NFP data for clearer directions on XAU/USD. Additionally, developments in US-China relations and speeches from central bankers could provide entertainment for Gold sellers.

The recent lack of clear direction in the yellow metal can be attributed to a cautious market sentiment ahead of crucial US inflation clues and mixed economic data from China. Furthermore, limited market participation due to quarter-end positioning has also contributed to the recent lack of movement in XAU/USD.

Yesterday, Gold Price (XAU/USD) dropped below the $1,900 threshold, hitting a 3.5-month low. This decline was fueled by positive US data, which increased expectations of more rate hikes by the Fed. Comments from Fed Chair Jerome Powell and Atlanta Federal Reserve President Raphael Bostic further supported this sentiment. It’s worth noting that the People’s Bank of China’s sustained defense of the Yuan, despite significant costs, along with China’s PMI prints below 50.0, have also exerted downward pressure on the Gold Price.

Meanwhile, with firmer equities and Treasury bond yields, traders are finding more favorable opportunities elsewhere, leaving Gold bears hopeful.

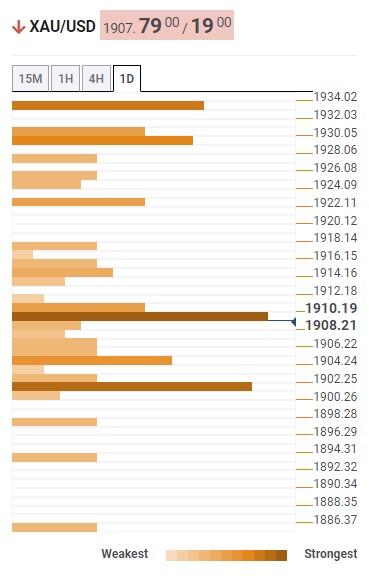

Gold Price: Key levels to watch

Our Technical Confluence Indicator suggests that Gold price is currently grappling with key intraday resistance while gradually surpassing short-term important support levels.

However, immediate recovery of the Gold Price is hindered by the $1,910 level, which includes Fibonacci 23.6% on a one-day basis and the previous weekly low.

On the downside, the lower band of the Bollinger on a one-day basis, Fibonacci 61.8% on a one-day basis, and Pivot Point one-week S1 collectively provide support near the psychological magnet of $1,900 for XAU/USD.

It’s worth noting that the Pivot Point one-month S1, around $1,905, offers immediate support for Gold sellers.

If the Gold Price manages to rise above $1,910, there is a possibility of a gradual climb towards the Fibonacci 38.2% on a one-week basis, near $1,930, and then towards the previous monthly low of approximately $1,934.

Alternatively, if the Gold Price breaks below $1,900, there is a relatively clear path to the downside before reaching the Pivot Point one-day S2 near $1,886.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool that identifies and highlights price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, and more. If you are a short-term trader, this tool can help you find entry points for counter-trend strategies and capture a few points at a time. If you are a medium-to-long-term trader, the TCD allows you to anticipate price levels where a medium-to-long-term trend may pause or reverse, providing insights on when to unwind positions or increase your position size.